OBSERVER / ANALYTICS

Freedom of choice of dependence in conditions of geoeconomic fragmentation

2024-10-01

Why China may be interested in cooperation with Ukraine in the spheres of production and supply.

Photo source: https://www.ukrinform.ua/rubric-economy/3910166-svoboda-viboru-zaleznosti-v-umovah-geoekonomicnoi-fragmentacii.html

Increasing geopolitical tensions, the spread of protectionism and quarantine restrictions have called into question the reliability of global supply chains. Their reorientation, taking into account the need to ensure national interests, can lead to economic losses for individual countries, as well as for the world in general - says the publication "Vox Ukraine» by Olga Bondarenko, Senior Economist of the Department of International Economic Analysis of the Department of Monetary Policy and Economic Analysis of the NBU.

However, the importance of gaining access to key resources without infrastructural or geopolitical risks should not be underestimated. EU, who was convinced by his own experience of the importance of such access, remains closely connected by trade with countries of a different geopolitical direction, primarily with China. And therefore, he may be interested in cooperation with Ukraine to diversify the sources of supply of certain goods and/or transfer their production.

The trend towards geo-economic fragmentation: excuse me, globalization?

From the beginning of the 1990s until the global financial crisis 2008 production of goods and services became increasingly globalized. To increase own efficiency and reduce the cost of the final product, companies created complex supply chains, in which development, parts manufacturing and final assembly took place in different countries. However, increasing geopolitical tensions, the spread of protectionism and quarantine restrictions called into question their reliability.

Consequently, companies were increasingly considering the possibility of transferring production to nearby ones (near-shoring) or geopolitically close (friend-shoring) countries, as well as his return to the country of origin (re-shoring). An alternative approach was to decentralize activities among a larger number of countries (diversification).

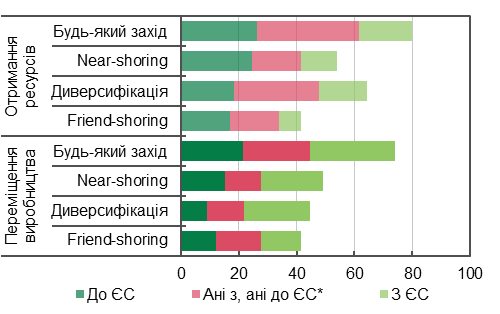

IN 2023 year 74% of multinational corporations with a significant presence in the EU planned to take at least one of these measures within the next five years, whereas in the previous five years they were only able to do so 42%. Friend-shoring has become almost four times more popular, however, the share of those also increased, who planned to move production from the EU to other countries as part of this move (schedule 1).

Schedule 1. Planned activities of multinational companies, operating in the Eurozone, for the next ones 5 years, % interviewed

Any event from the listed - near-, friend-shoring, and/or diversification. Company responses, which did not plan to move production as from the EU, and to him. Source: ECB survey in July-August 2023 year.

To reduce risks, caused by interdependence with geopolitical opponents, representatives of governments also called. The US emphasized the importance of cooperation with allies and partners. The EU is on increasing competitiveness, stability and security of own economy. China is self-sufficient, especially in the development of technology.

Fragmentation is already affecting the dynamics of certain economic indicators. So, since the beginning of the full-scale invasion of Russia into Ukraine, the growth rate of trade between geopolitically close people (according to votes in the UN) countries were on 3,8 at. P. higher, than between geopolitically distant ones. Private foreign investments showed similar trends (FDI).

A negative sum game: losses cannot be avoided?

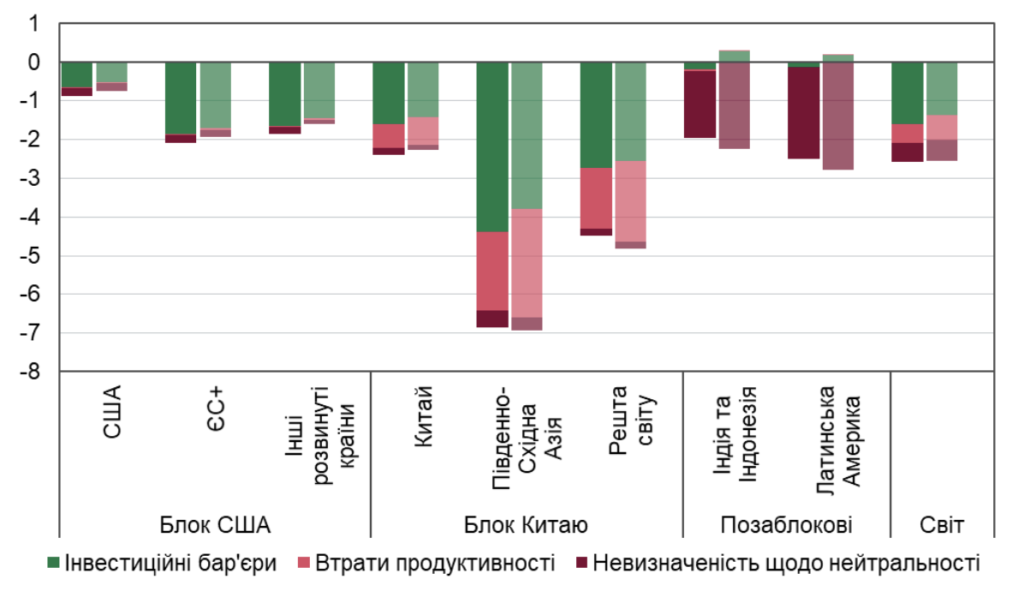

Economists predict significant losses from geoeconomic fragmentation for the world economy and trade. The reduction of world GDP in the long term is estimated from 0,2% to 7,0% (Aiyar et al., 2023) depending on the type of trade restrictions, influence channels and fragmentation scenarios, that combine countries into "blocs" in different ways [1].

For individual countries, probable losses from friend-shoring in the event of a world division into two blocs (with the US-EU and China centers of gravity) range from a paltry 0.1–0.6% of GDP in Scandinavia to 2.3–2.8% of GDP in Kazakhstan and 2–4.6% of GDP in Morocco (Javorcik et al., 2022).

However, the strategy of geopolitical neutrality has perhaps the most disagreements in estimates of economic impact. On the one hand, third countries can attract additional trade and investment volumes from both blocs, at least in the short term. Example, in 2022–2023, new FDI was primarily directed not even to geopolitically close, and to neutral countries [2]. In particular, in the 3rd quarter 2023 year there were almost such 40% from announced projects. Accordingly, the GDP of such countries, according to IMF estimates, may grow slightly (within 0,1-0,2%) due to moderate fragmentation.

On the other hand, a decrease in aggregate demand in the leading economies may offset the change in trade flows in favor of third countries. According to IMF estimates, due to the reduction of the OECD's dependence on goods from China and vice versa (friend-shoring) GDP and exports of Southeast Asia will decrease in the long term by 0,2-0,7% compared to the baseline scenario.

In general, if the country has to abandon geopolitical neutrality and limit trade with one of the blocs, negative impact on both global GDP, and the volume of output of such countries will be greater (Bolhuis et al., 2023; Cerdeiro et al., 2021). However, it is more difficult to sit on two chairs, than it might seem at first glance. Strategic uncertainty regarding the long-term preservation of such neutrality actually negates its benefits due to the risks of low investment from both blocs.

Schedule 2. Losses of GDP* in the long term, % deviating from the fragmentation-free scenario

* Estimates with a higher elasticity of substitution are marked with a more transparent color. Source: the som.

in addition, the price of a mistake can be high. Example, if Latin America gravitates towards China's position (instead of US-EU), then it will suffer from fragmentation twice as much due to the negative impact on performance (Goes and Bekkers, 2023).

Besides, not all new FDI, attracted through the redistribution of economic flows, equally contribute to the transfer of knowledge and technology. At least some of them can be used simply to circumvent trade restrictions. So, relatively more Chinese FDI with 2017 of the year received countries, whose share in US imports grew the most, including Mexico and Vietnam. The shares of these two countries in Chinese exports also increased, so it can be assumed, that trade between the US and China was redirected through them. The BIS study also found lengthening supply chains in 2022-2023, especially from China to the US. However, unlike friend-shoring, this did not diminish the real interdependence of these two markets.

EU and China: the connection is unbreakable?

The EU has learned from its own experience the value of sustainable access to key resources or production components. The first challenge was the shortage of semiconductors, due to the fight against the COVID-19 pandemic. It had a more significant impact on the economies of the EU countries, in which the leading consumer was the automotive industry. Instead, in the USA and China, they were ordered primarily by manufacturers of telecommunications and computer equipment, which were first in line after the automakers and their direct suppliers canceled their own orders.

The second challenge was dependence on Russian gas. Europe's infrastructure has withstood the reduction of Russian pipeline gas supplies by more than 55% in 2022 year. However, this was achieved also due to the reduction of its consumption by industry, which restrained economic growth.

Both challenges worsened the position of the EU in the world economy: its share in world GDP (for PKC) with 2019 to 2023 decreased by 0,8 at. P. to 14,5%. Therefore, reducing the vulnerability of supply chains can become an important aspect of sustainable economic development in the EU.

If the dependence on Russia was manifested in the chains of added value of the EU, primarily in the raw material sectors (extraction of energy and non-energy minerals, metallurgy), then dependence on other geopolitically distant countries, primarily China, also affects technological sectors.

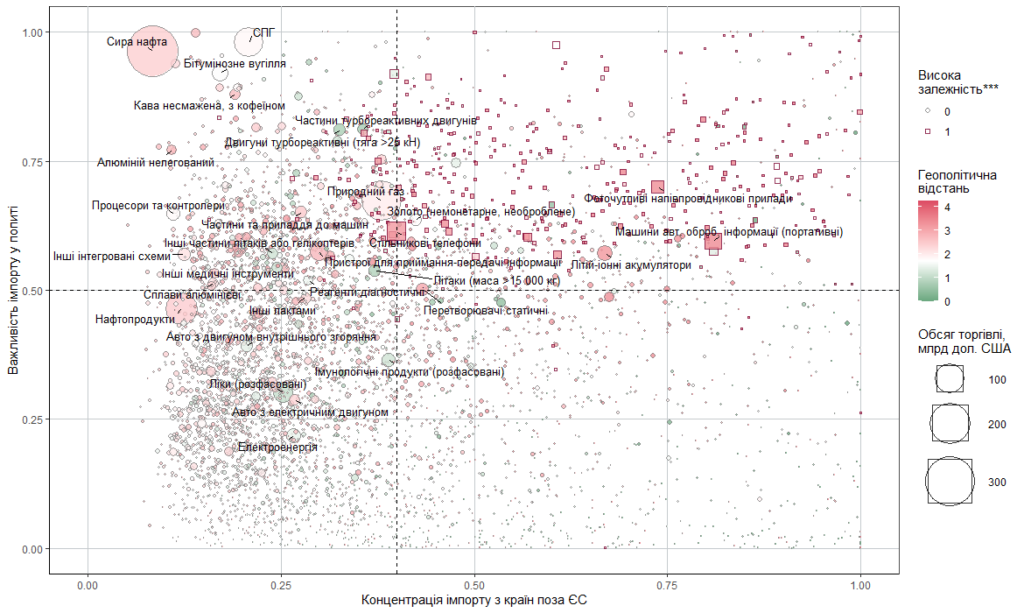

In general, for goods with a high degree of dependence, i.e. such, which the EU cannot easily replace (see details. a note to the schedule 3) in 2022 year accounted for less 9% imports of the European Union. However, this does not diminish their importance in the internal demand of the EU. For example, critical raw materials (KST) usually used in relatively small amounts, however, they are indispensable for the production of most technological goods. On the graph, goods with a high degree of dependence are marked with squares. The greatest supply chain risks exist for commodities, which are marked with pink squares and are located in the upper right part of the graph - i.e. those, which come from geopolitically distant countries and the import of which is important and fairly monopolized. Oil, on the other hand, is important and heavy in terms of volume (close 10% of all imports, on the graph is marked with a pink circle) was sufficiently diversified, in order not to fall under the criteria of dependence.

Schedule 3. EU imports by dependency indicators*, trade volumes and weighted average geopolitical distance** to exporting countries

* According to the methodology of the European Commission, a product with a high degree of dependence is that, which has a concentration indicator at the same time (the Herfindahl-Hirschman index by shares of exporting countries in EU imports) higher 0,4, importance indicator (share of imports from outside the EU in total EU imports) higher 0,5 and interchangeability index (the ratio of imports from countries outside the EU to total EU exports) exceeds 1,0. ** Geopolitical distance is defined as the difference in UN votes between the respective country and the US according to Bailey et al. (2009). Overseas territories, Hong Kong and Macau have the same geopolitical distance, as well as countries, that represent them; for Taiwan is the average geopolitical distance of the G7 countries. A smaller distance is closer to the positions of the USA in the UN votes 2022 year, larger - closer to the positions of China. On the graph, squares indicate goods with a high degree of dependence in at least four of the five years in the period 2018-2022 years. Additional information on the EU's dependence on trade and ways to involve Ukraine in EU supply chains is in the thematic insert of the Inflation Report for July 2024 of the year - "Friend-shoring for the EU - an opportunity for Ukraine?». Source: NBU calculations based on BACI-CEPII data.

IN 2022 In 2015, China supplied more than half of goods with a high degree of import dependence to the EU and was among the top three suppliers in 65% cases. The role of other countries was much smaller - the shares of each of them in imports did not exceed 6%.

In agriculture and the textile industry, the EU's dependence on imports is mainly due to its geographical location (example, ginseng, coconut oil, bamboo, rattan, silk, cashmere, etc) and features of the globalization of the fashion industry in previous years. However, they do not pose significant risks for the EU, in particular thanks to the common agricultural policy of the association, which ensures a constant supply of plant and animal husbandry products characteristic of the European region.

Instead, strategic dependencies exist in energy-intensive production, renewable energy, defense and aerospace industries, digital technologies, electronics and health care. Disruption of supply chains in these sectors could significantly affect the EU's ability to ensure the health and safety of its citizens, and to achieve environmental and digital transformation.

Their original source is that, that there are no significant deposits of critical raw materials in the EU, in particular magnesium, rare earth elements, platinoids, etc. Often diversification of the supply of KST from such countries, like China or South Africa, not only the concentration of minerals in these countries hindered, and the concentration of KST processing at the world level. So, China's share in cobalt processing is over 75%, while in mining it is less 3%. This is ensured by the supply of unprocessed cobalt from the Democratic Republic of the Congo (close 65% world production), almost 50% which is controlled by Chinese companies. in addition, over 70% of world trade in cobalt was subject to export restrictions – the largest among major CSTs.

Accordingly, the EU depends on the import of units and aggregates, made on the basis of compounds of critical raw materials. China currently dominates the entire battery supply chain, solar panels and wind turbines, and also occupies an important place in the production of components for traction engines, robots and drones, electronics. Consequently, in semiconductors, the EU is a net importer of diodes and transistors from China and advanced chips from Taiwan.

Schedule 4. China's share in the global production of units and aggregates of relevant goods, %

* Total for Asia (China, Japan, Korea, Taiwan and the rest of Asia). Source: JRC Science for Policy Report.

China itself, which in a few decades turned into a "world factory", depended primarily on Western technologies - equipment, in particular highly specialized, semiconductors (here, Taiwan is included in the US-EU bloc), aircraft and pharmaceutical products. Rising living standards in China have created demand for certain luxury goods (jewelry, perfume, cosmetics of leading brands). Western countries also played an important role in the supply of iron ore and food (grains, meat, soybean, dairy products). Today, China, as a leading food producer, is increasing its focus on self-sufficiency, and also deepens cooperation with other countries, including Russia, which is a competitor of Ukraine in many product groups.

Place of Ukraine: are there grounds for optimism?

According to Javorcik et al. (2022), one of the problems of friend-shoring is the similar level of economic development of geopolitically close countries. And therefore, prioritizing trade with such countries significantly reduces opportunities to use comparative advantages (comparative advantages). However, Ukraine can become an alternative for the EU to more geopolitically distant Emerging Market countries (EM) with comparatively smaller economic losses, after all, it is an EM country itself.

As shown by the rather quick rejection of Russian goods, The EU has the potential to reorient trade in favor of geopolitically close countries. IN 2023 Russia's share in EU imports decreased immediately by 4,7 at. P. compared to the previous year (to 2% total import) due to the introduction of EU economic sanctions and diversification of supplies. However, it continued to exceed Ukraine's share, which even before a full-scale invasion amounted to only 1,1%.

The total volume of EU imports of goods with a high degree of dependence on 2022 year was almost 263 billion. USA, which was more than ten times the volume of Ukraine's exports to the EU (close 25 billion. USA). Of course, Ukraine will not be able to become a supplier of all such goods, but the outlook is cautiously optimistic as in traditional industries (agriculture, mining and metallurgy), as well as in the production of technological goods.

Ukraine already has a successful experience of cooperation with European manufacturers, therefore, its involvement in the supply chains of the EU for the manufacture of batteries, solar panels, semiconductors should be a priority. This will be facilitated by the presence in Ukraine of more than half of the CST from the EU list, of which only some deposits have been developed so far (example, graphite and titanium ores).

Experience in the development and localization of industrial complex, including drones, in conditions of war with operational testing of developments on the battlefield may also be of interest to European partners. in addition, in conditions of limited resources, the development of secondary processing of materials in Ukraine is urgent, as the recent experience of the Ministry of Defense showed. Cooperation in the pharmaceutical industry (provided that Ukraine receives a "pharmaceutical visa-free") can help the EU replace products from Asia, primarily active pharmaceutical ingredients from China.

However, it is worth recognizing, that the main prerequisites for the realization of this potential are the reduction of security risks and the implementation of reforms, in particular, from the protection of property rights. Important factors for the development of production capacity will be the expansion of the labor force supply and the restoration of the energy industry.

For its part, the EU can contribute to increasing investments in Ukraine and improving business conditions by ensuring constructive cooperation, in particular, in the matter of access to EU markets without political and regulatory risks.

Leave